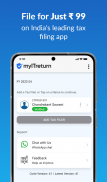

Income tax return filing App

Description of Income tax return filing App

myITreturn mobile app is an easy and quick way to file your Income tax return and stay updated with your Income-tax information. Quickly calculate your Income-tax, know the status of your e-filed Income-tax return, see the status of your income tax refund find your Assessing Officer and receive timely app notifications.

Multi Language Support (Beta)

**************************

Hindi

Gujarathi

Marathi

Telugu

Tamil

Kannada

Malayalam

Punjabi

Bengali

Tax Filing

************************

People having Salary, House Property and Other Source Income can file their Income-tax return using this app in a quick fashion and get their acknowledgement.

Pricing plans for tax filing - http://myitreturn.com/pricing.php

App Features

-------------------------------------------------------

1) Tax Calculator

Calculate and plan your taxes for FY 2014-15. Simply feed in your Income details (Salary, House Property and Other Source Income) and Investment details (under Chapter VI A) to find out your tax liability. Calculator for FY 2015-16 (basis tentative tax slab) will be launched on 1st of April, 2015.

2) Refund Status

View your entire tax timeline using this service. Know the followings about your tax filing status, Refund status, etc.

3) HRA Rent Receipt generator

Generate rent receipt quickly and submit to your employer.

myITreturn.com is India's leading tax filing website helping lakhs of return filers every year. myITreturn is a project of Skorydov Systems Private Limited. Skorydov is an authorised e-Return Intermediary.

Presently all features are free to use. Tax filing service is as per pricing plans.

For support, please feel free to reach us on: help.myITreturn.com

Future versions will support tax payments from Banks like State Bank of India, Bank of India etc. myITreturn is a perfect Tax buddy to have. Install now.

- INDIA</br></br></br></br></br></br></br></br></br></br></br></br></br></br></br></br></br></br></br></br></br></br></br></br></br></br></br></br></br></br></br></br></br></br></br></br></br></br></br></br></br></br>